Flat tax

However many flat tax regimes have. A sales tax is levied on income-but only once and at one low rate-as it is spent.

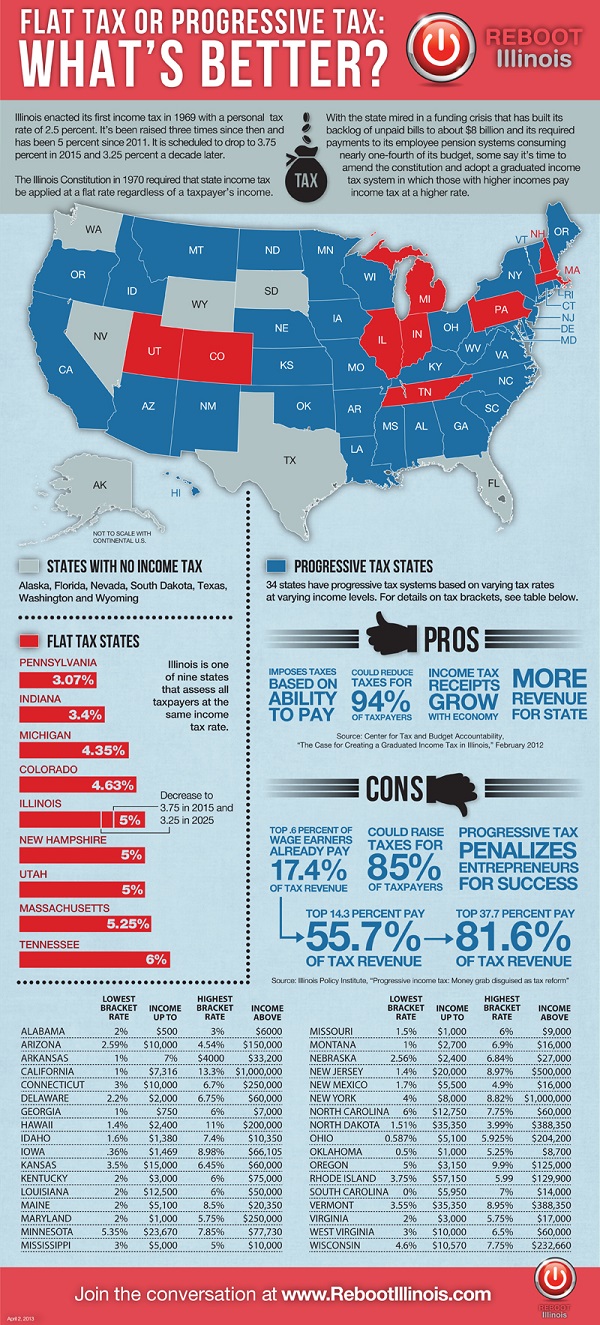

Flat Income Tax Progressive Tax No State Income Tax A Nationwide Overview Huffpost Chicago

A flat tax is levied on income-but only once and at one low rate-as it is earned.

. Graduated rates starting as low as 15. Depuis le 1er Janvier 2018 les revenus patrimoniaux plus particulièrement les revenus du capital sont soumis au Prélèvement Forfaitaire UniquePFU que lon appelle. Therefore except for the exemptions the economic.

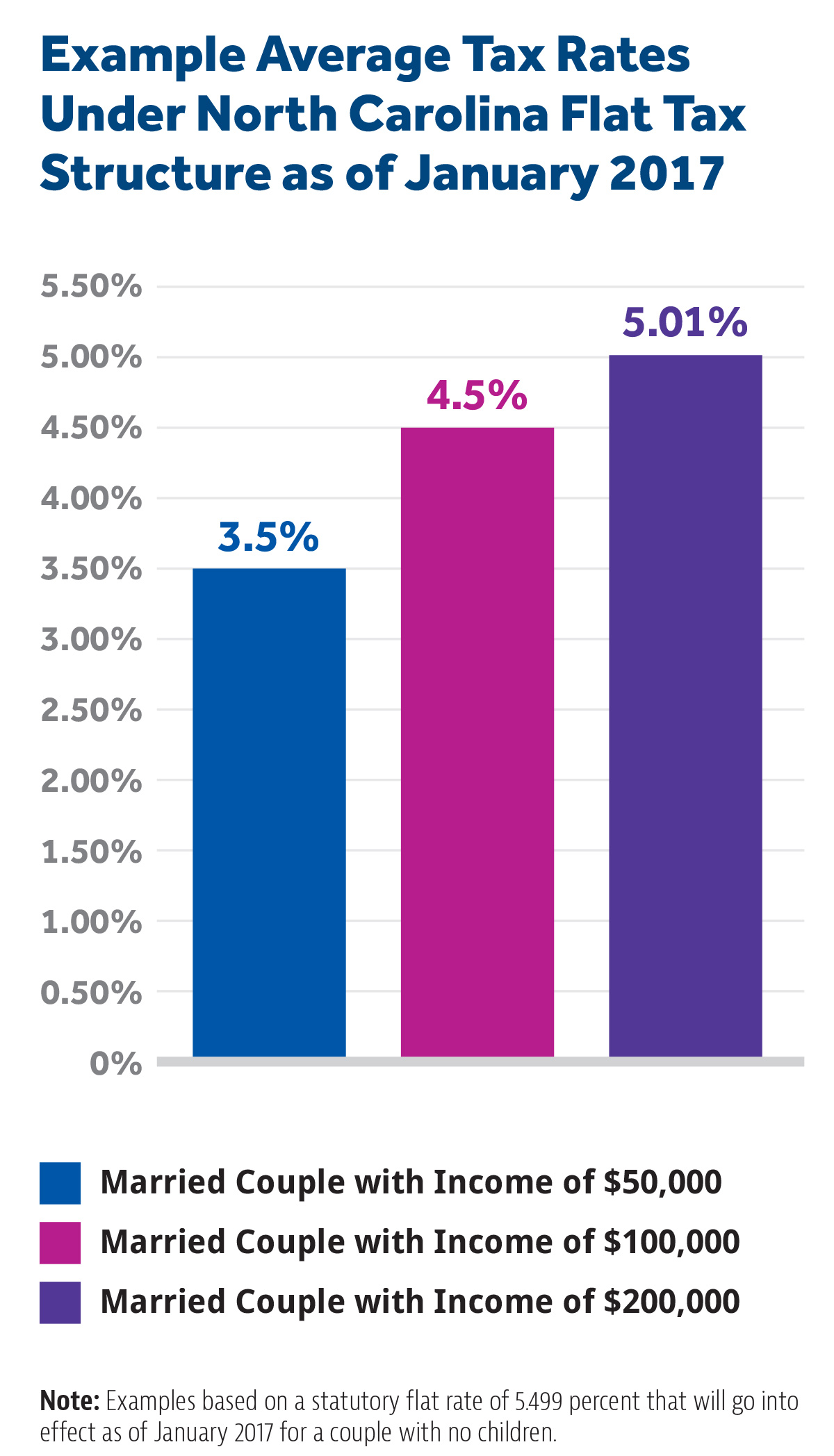

An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets. For example a tax rate of 10 would mean that an individual. A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets.

Most flat tax systems or. Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. For instance Russia has a flat tax rate of 13 and.

Flat tax a tax system that applies a single tax rate to all levels of income. Our opinions are our own. A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

It has been proposed as a replacement of the federal income tax in the United States which was based on a system of. Notably the flat rate would apply to taxable income over 2500 for single filers and over 5000 for joint filers creating an additional exclusion above and beyond the state. Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. Both the flat tax.

Flat tax rates vary from country to country as well as year to year depending upon the income level and government in power. A new structure that will be assessed at the market value of a new unit with similar structure example. Your property tax is linked to the price you paid for your property.

Expand Definition Stay informed with the. Here is a list of our partners and heres how we make money. A flat tax of 35 applies to the taxable income of a corporation that has taxable income for the year equal to or greater than USD 18333333.

If you bought your property before 1976 your propertys assessed value is frozen at its 1976 level. Governor Ducey signed the historic tax package into law last year further reducing and streamlining taxes for Arizonans while protecting small businesses from the threat of a 77. Your unit cost 100000 to build but.

Most Republicans Back A Flat Tax Yougov

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Assessing The Perry Flat Tax Tax Foundation

Assessing The Perry Flat Tax Tax Foundation

Cruz S Flat Tax Vat Would Cut Revenues By 8 6 Trillion Tax Policy Center

Flat Tax Revolution Using A Postcard To Abolish The Irs Forbes Steve 9780895260406 Amazon Com Books

Imf Survey Macedonia Makes Early Headway After Flat Tax Debut

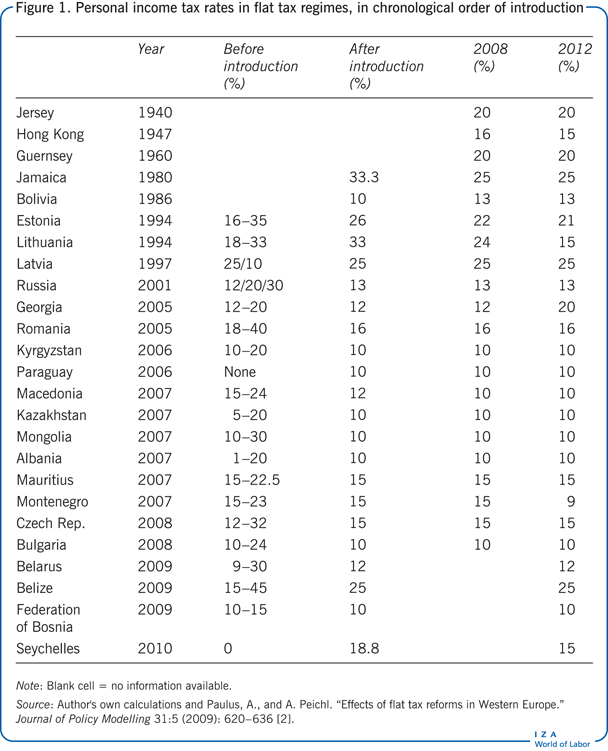

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

If Flat Is Fair Raise The Iowa Income Tax The Gazette

The Case For Flat Taxes The Economist

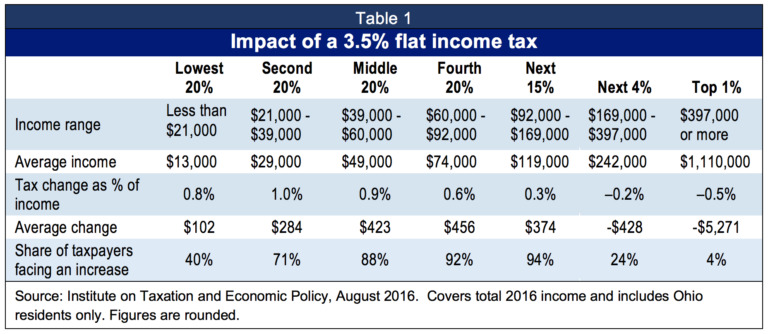

Flat Tax Would Mean More Taxes For Most

Dick Armey Steve Forbes S Plot To Raise Taxes On Most Texans Citizens For Tax Justice Working For A Fair And Sustainable Tax System

The Grumpy Economist Tax Graph

Progressivity And The Flat Tax

Flat Tax Or Flat Out Dead Reagan Nj Com

Open Letter We Are Against The Flat Tax Proposal

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

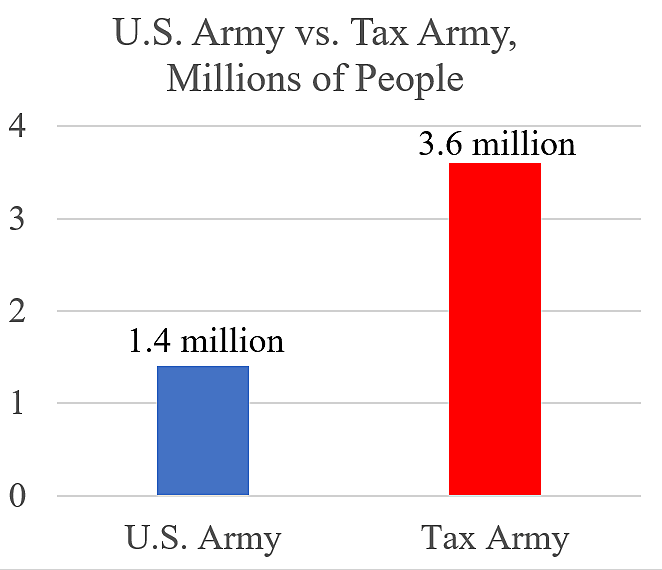

U S Tax Army To Expand Cato At Liberty Blog

The Flat Tax Falls Flat For Good Reasons The Washington Post